carbon tax vs cap and trade pros and cons

The horse-trading necessary to get a carbon tax passed. A cost is added to all emissions equal to the level of the tax and this causes people to cut back.

Learn about how and why companies should be using carbon credits.

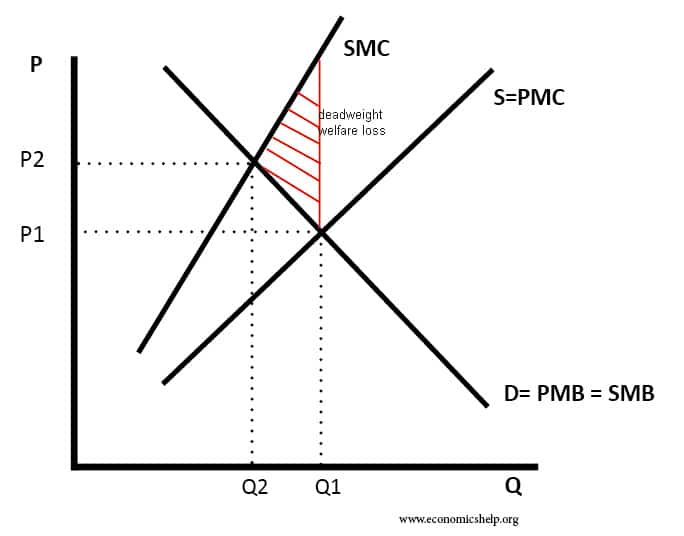

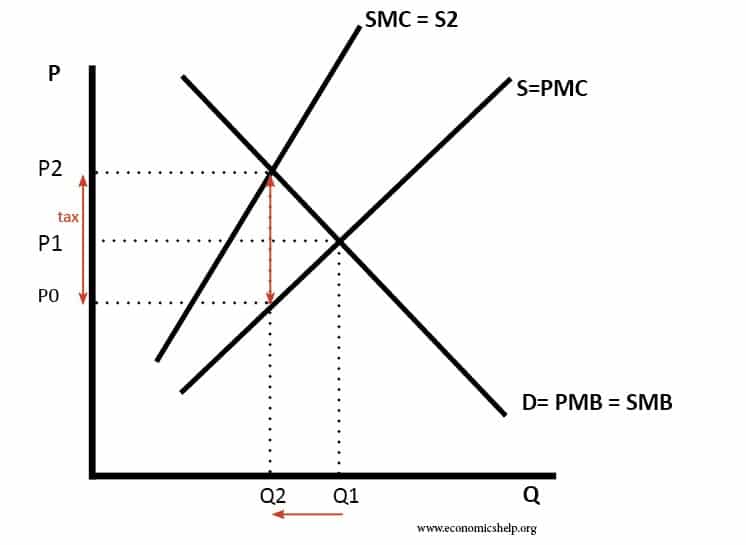

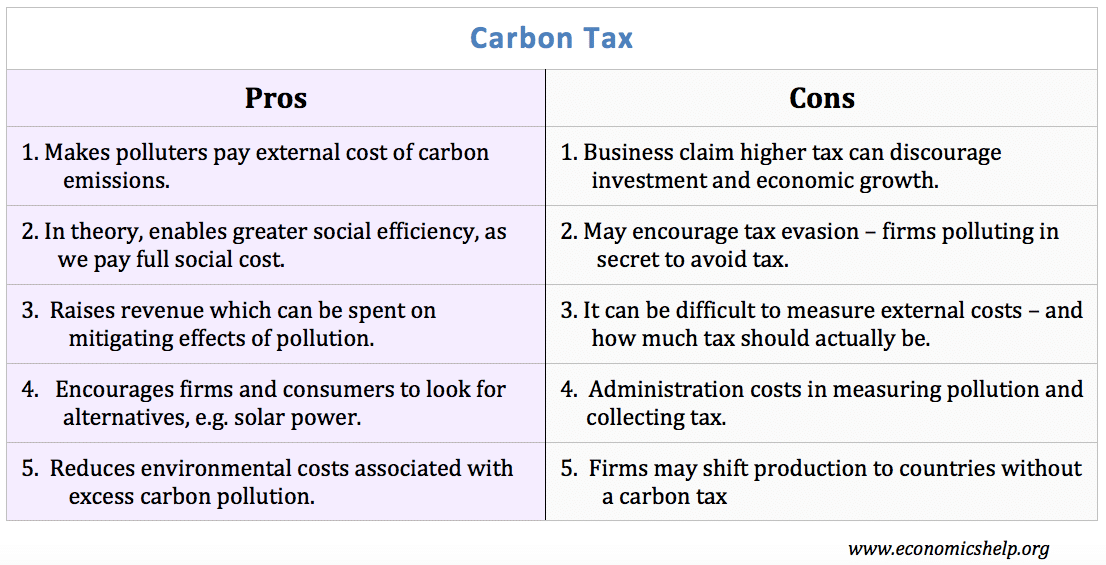

. The price of the carbon is determined by assessing the cost of damage associated with each unit of pollution and the cost of controlling that pollution Grantham Research Institute 2013. If its too low firms may decide its cheaper to pollute and pay the tax. There is no cap on emissions in a.

A carbon tax is sort of the opposite. There is less agreement however among economists and others in the policy community regarding the choice of specific carbon-pricing policy instrument with some supporting carbon taxes and others favoring cap-and-trade mechanisms. Swift and deep reductions in emissions of greenhouse gases chiefly carbon dioxide are necessary to help avoid some of the most devastating effects of climate change.

Carbon tax vs emissions trading. The carbon tax is a financial measure of the actual cost of greenhouse gases and its impact on the economy Carbon Tax or Cap-and-Trade 2014. A Critical Review by Lawrence Goulder and Andrew Schein of Stanford University.

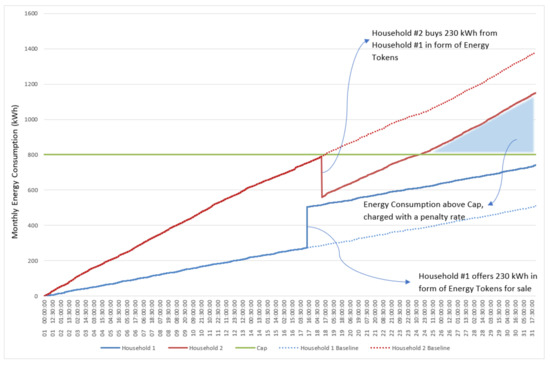

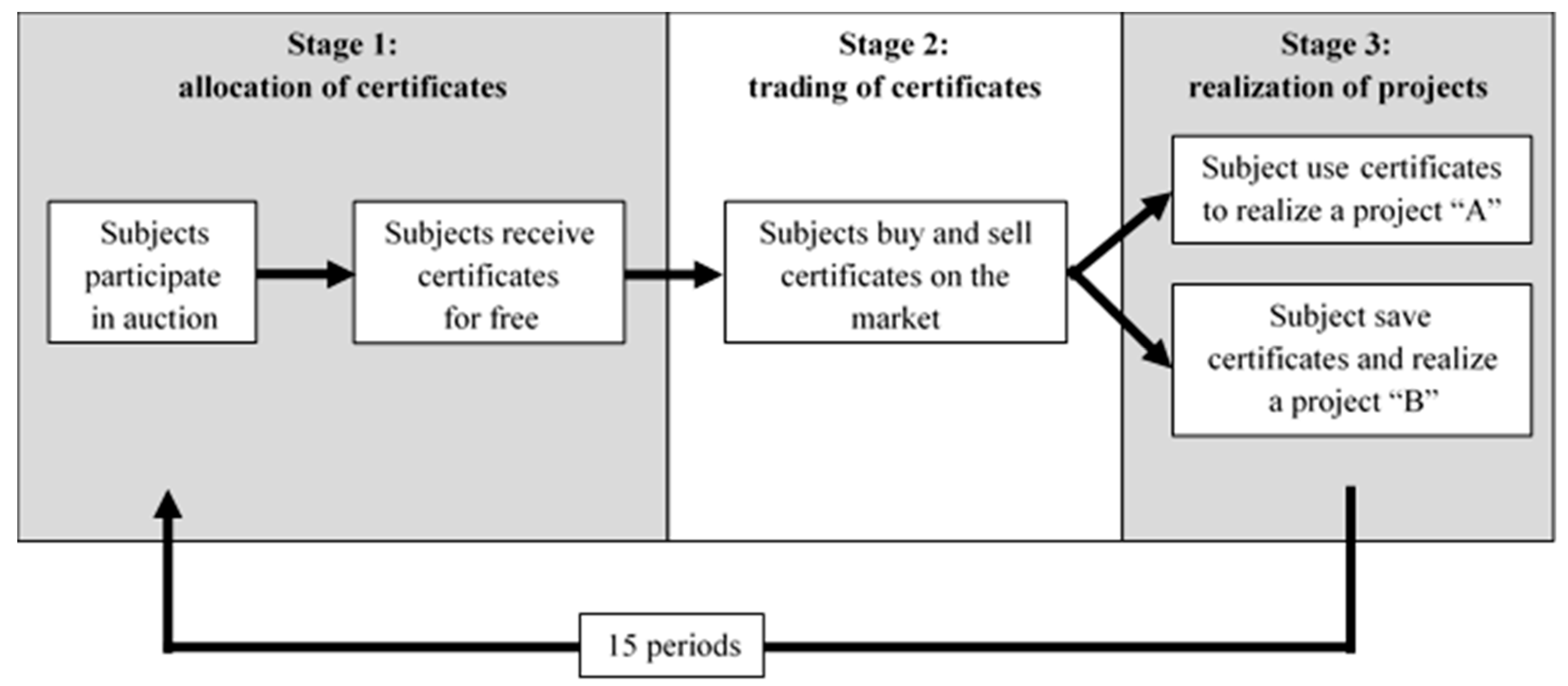

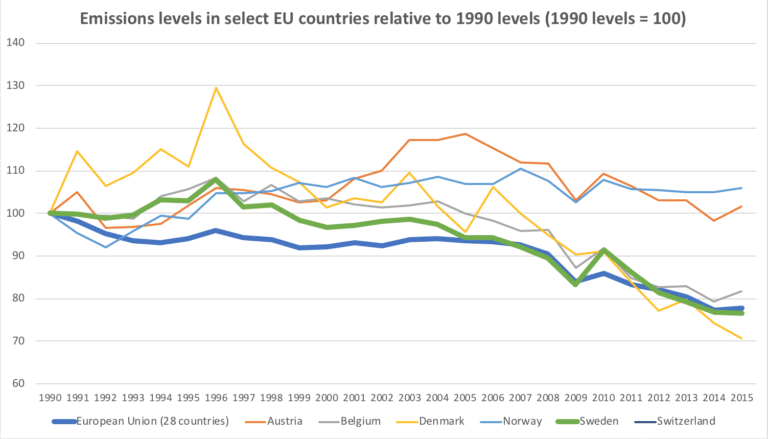

Tyler Cowen recommends Carbon Taxes vs. Now lets consider a scenario with carbon credits also known as emissions trading or cap and trade. For example European countries have operated a cap-and-trade program since 2005.

While a carbon tax sets the price of CO2 emissions and allows the market to determine the amount of reduced emissions a cap-and-trade system sets the quantity of emissions allowed which can then be used to estimate the decline in the rise of global temperatures. Until recently cap and trade commanded most of the attention in policy circles. Theory and practice Robert N.

Carbon taxes vs. Economists usually prefer taxation over quality controls due to incentives such as the continual motivation to reduce consumption on the taxed pollution Brander 2014 p. The Canadian federal tax will price carbon at 20 a ton or 44 cents per liter of gasoline and rise to 50 in 2020.

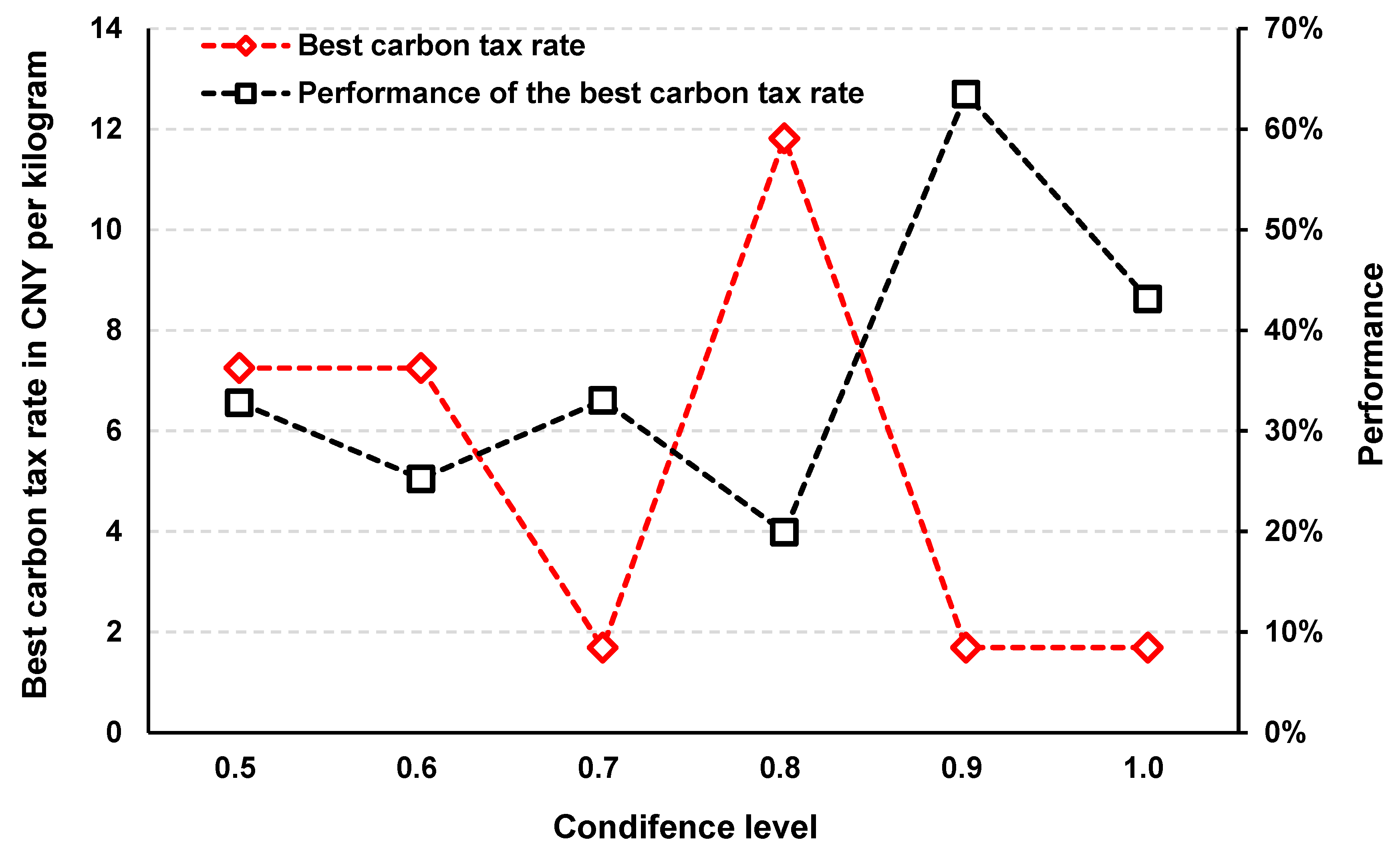

Service notes that legislators could also choose to establish a carbon tax framework that rivals the complexity of a cap-and-trade program such as that passed by the House in 2009 but never by the Senate. The key to carbon taxes is knowing just how high or low to set the tax. Pros and cons of a carbon tax by John Wihbey July 20 2016 October 15 2020.

How do the two major approaches to carbon pricing compare on relevant dimensions including but not limited to. We show that the various options are equivalent along more dimensions than often are recognized. With regards to which.

Together Company A and B emitted 200 units last year and the government wants to halve. This is right up there with lead abatement on. Mexico is running a pilot cap-and-trade program that the.

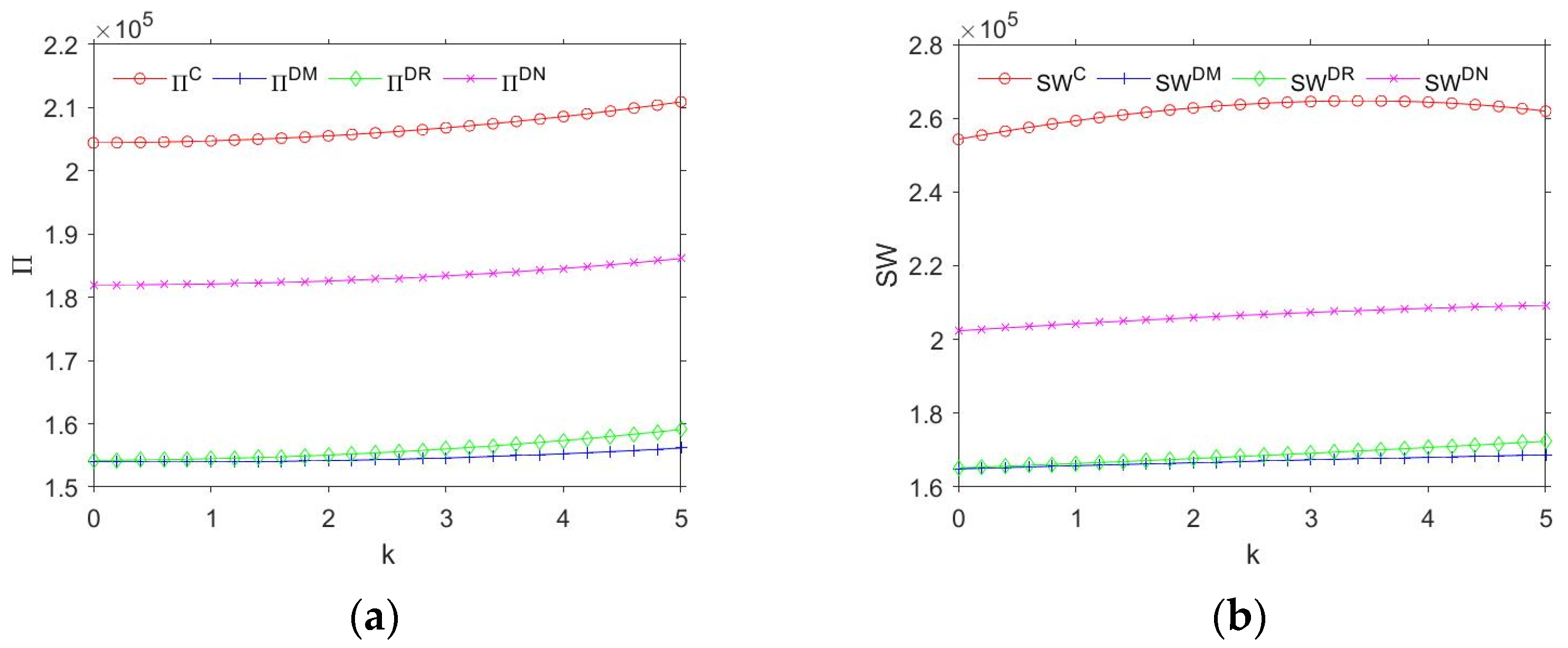

We examine the relative attractions of a carbon tax a pure cap-and-trade system and a hybrid option a cap-and-trade system with a price ceiling andor price floor. Emissions trading or cap-and-trade CAT and a carbon tax are fundamentally different tools to limit the. A trade refers to the transfer of permits that have to be bought by firms that need to increase their volume of emissions from firms that require fewer permits 1.

Three years ago 56 percent of Canadians supported a national carbon tax plan. But interest in the carbon tax seems to be on the rise in the US at least. However a cap-and-trade policy offers its own advantages in that emissions allowances can be allocated so as to minimize the policys negative effects on.

A carbon tax has a major advantage over cap-and-trade and a hybrid version because it allows for carbon price certainty is less costly to administer and is a substantial source of revenue. The cap aspect is where a government sets an emission cap and issues a. In addition we bring out important dimensions along which the.

The carbon tax is the most equitable method for carbon use to pay for its pollution. One aspect of US climate policy that is particularly contentious is the issue of the best economic tool to employ to reduce emissions. Ad This guide helps you evaluate the role of carbon credits in corporate climate strategies.

A carbon tax or a cap-and-trade system. Cap and trade or emissions trading is a common term for a government regulatory program designed to limit or cap the total level of specific chemical by-products resulting from private. The term cap means the limit or the maximum of the amount of pollutant to be emitted.

Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon taxes and cap and trade in the context of a possible future climate policy and does so. The carbon tax method is a tax on the carbon content of fuels effectively a tax on the carbon. The tax rate on carbon products should be attaches to objective CO2 tonnage contributed to the atmosphere.

The system needs to be employed by law similar to other sin taxes on alcohol tobaccos and even sales taxes. Today cap and trade is used or being developed in all parts of the world. Several Chinese cities and provinces have had carbon caps since 2013 and the government is working toward a national program.

There is a debate over which policy is best to moderate the use of fossil fuels and limit carbon emissions and pollution as a result of the combustion of these fuels for electrical generation and other uses. Policy makers discouraged with the inability to pass federal cap-and-trade legislation are.

Carbon Tax Pros And Cons Economics Help

Sustainability Free Full Text The Role Of Embodied Carbon Databases In The Accuracy Of Life Cycle Assessment Lca Calculations For The Embodied Carbon Of Buildings Html

Carbon Tax Pros And Cons Economics Help

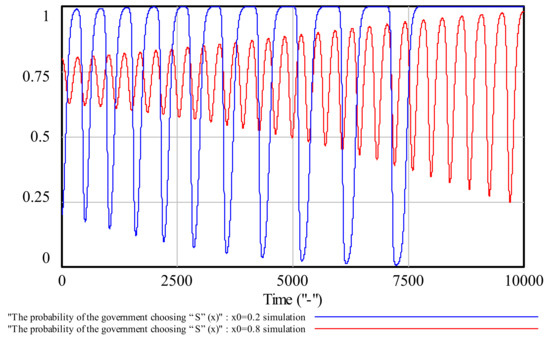

Sustainability Free Full Text The System Dynamics Sd Analysis Of The Government And Power Producers Evolutionary Game Strategies Based On Carbon Trading Ct Mechanism A Case Of China Html

Energies December 2 2021 Browse Articles

Sustainability Free Full Text The Impact Of Government Intervention And Cap And Trade On Green Innovation In Supply Chains A Social Welfare Perspective

Carbon Tax Pros And Cons Economics Help

Sustainability Free Full Text Laboratory Experiments Of Tradable Development Rights A Synthesis Of Different Treatments Html

Carbon Tax Pros And Cons Economics Help

Sustainability Free Full Text Fuzzy Linear Programming Models For A Green Logistics Center Location And Allocation Problem Under Mixed Uncertainties Based On Different Carbon Dioxide Emission Reduction Methods Html

Carbon Tax Pros And Cons Economics Help

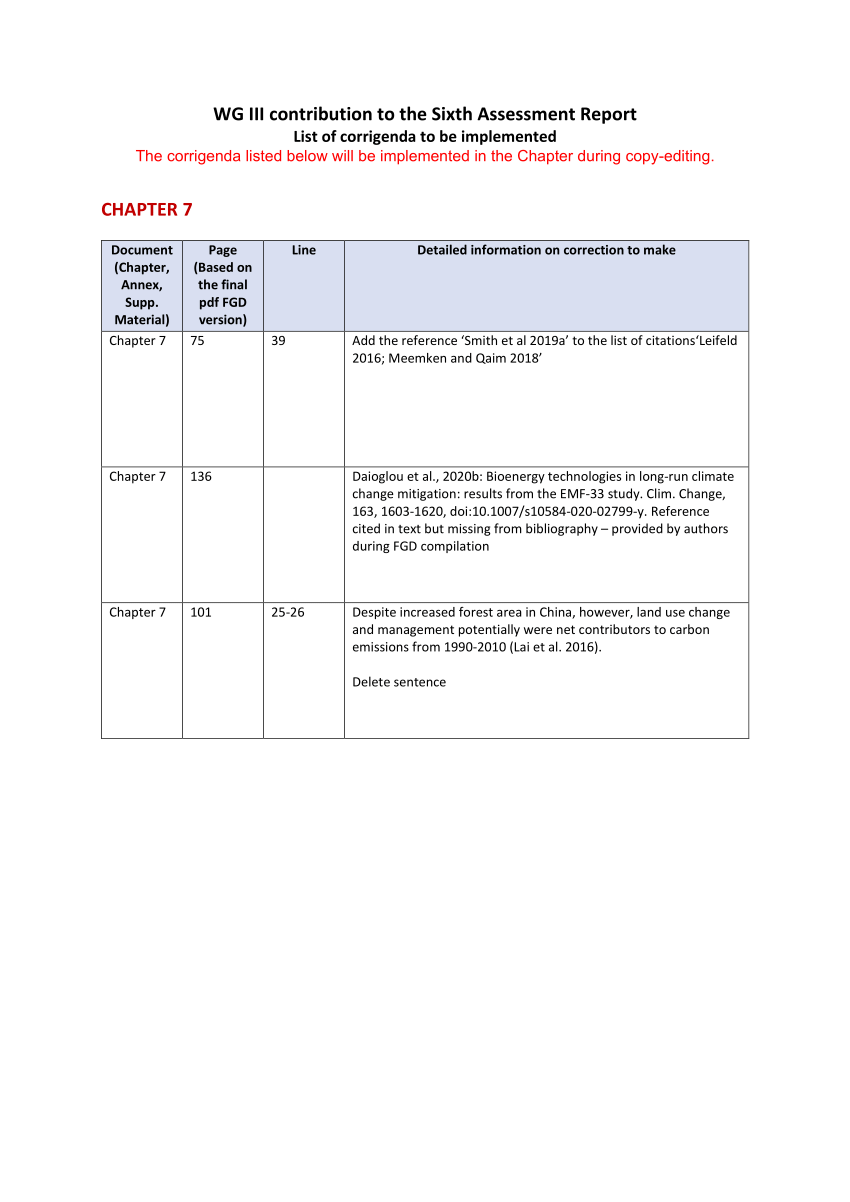

Pdf Ipcc Ar6 Wgiii Finaldraft Chapter07 Afolu

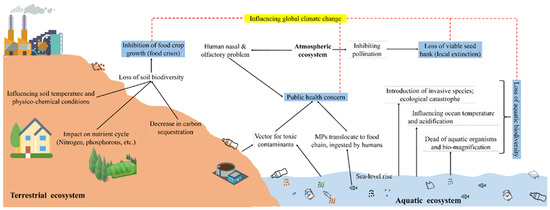

Sustainability Free Full Text Impacts Of Plastic Pollution On Ecosystem Services Sustainable Development Goals And Need To Focus On Circular Economy And Policy Interventions Html